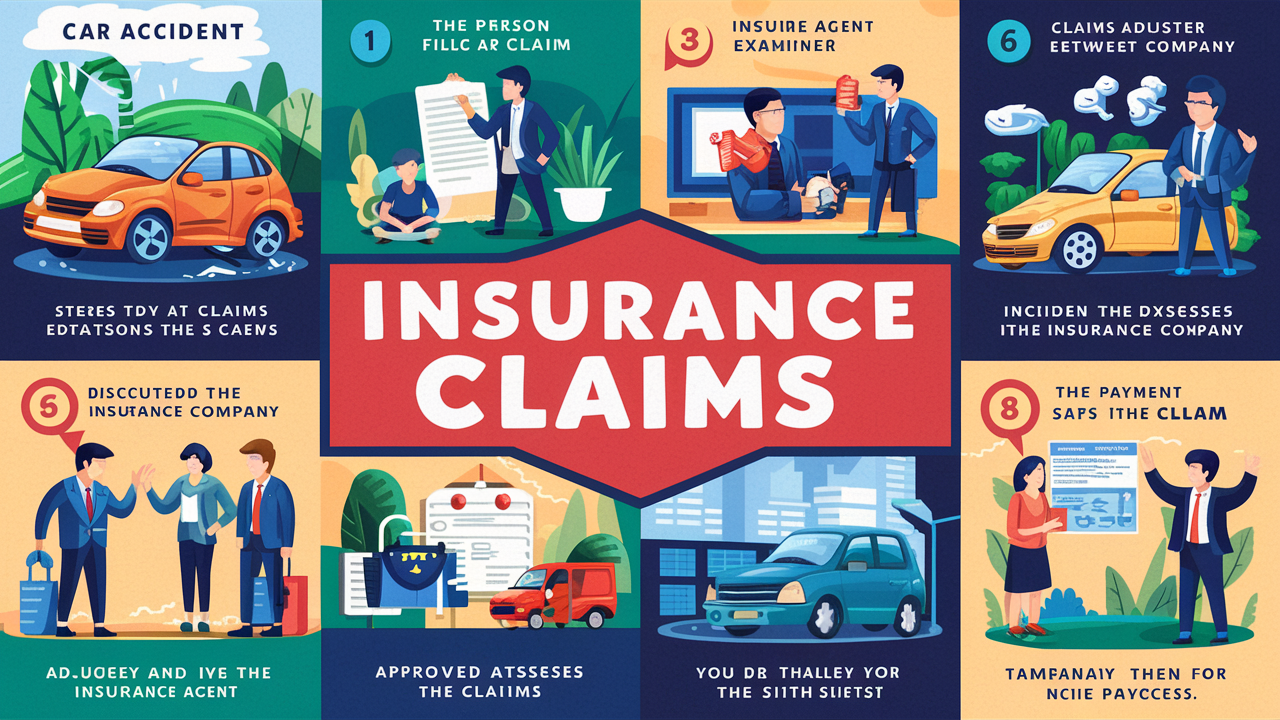

Navigating the claims process and settlement can be a daunting task, but understanding each step can make it much smoother. Whether you’re dealing with an insurance claim for health, auto, home, or another type of coverage, this guide will walk you through the process in a clear and concise manner. Let’s explain it.

Step By Step Guide of Claims process and settlement

1. Understand Your Policy

Before you begin the claims process, it’s essential to understand your insurance policy. Know what is covered, the limits of your coverage, and any exclusions. This will help set your expectations and ensure you have all necessary information at hand.

2. Report the Incident

As soon as an incident occurs, report it to your insurance company. Whether it’s a car accident, a health issue, or damage to your home, timely reporting is crucial. Most insurers have a 24/7 hotline or an online claims form you can fill out.

3. Provide Detailed Information

When filing your claim, provide as much detail as possible. This includes:

- Date and time of the incident

- Description of what happened

- Photos or videos of the damage

- Police reports or other relevant documents

4. Cooperate with the Claims Adjuster

Once your claim is filed, an insurance adjuster will be assigned to your case. Their job is to assess the damage and determine the payout. Be sure to:

- Answer all their questions honestly

- Provide any additional information they request

- Allow them to inspect the damage if needed

5. Review the Settlement Offer

After the adjuster completes their assessment, you’ll receive a settlement offer. This is the amount your insurance company is willing to pay based on your policy and the adjuster’s evaluation. Carefully review the offer:

- Ensure it covers all necessary repairs or replacements

- Compare it to your policy’s coverage limits

If you disagree with the offer, you can negotiate. Provide evidence to support your case, such as repair estimates or second opinions.

6. Accept the Settlement

If you’re satisfied with the offer, accept it, and the insurance company will process your payment. The settlement can be used to pay for repairs, replacements, or medical bills, depending on your claim type.

7. Follow Up

After receiving your settlement, follow up to ensure all repairs or medical treatments are completed satisfactorily. Keep all receipts and documentation in case further action is needed.

Tips for a Smooth Claims Process

- Document Everything: Keep thorough records of all communications, receipts, and documents related to your claim.

- Be Prompt: Report incidents and file claims as soon as possible to avoid delays.

- Stay Informed: Understand your rights and responsibilities under your policy.

- Ask Questions: If you’re unsure about any part of the process, don’t hesitate to ask your insurance representative.

Related Article: Top 10 Emerging Trends in Insurance Industry for 2024

Conclusion

Understanding the claims process and settlement can save you time, stress, and money. By following these steps and tips, you can ensure a smoother experience and get the compensation you deserve. Remember, your insurance company is there to help, so don’t hesitate to reach out with any questions or concerns.