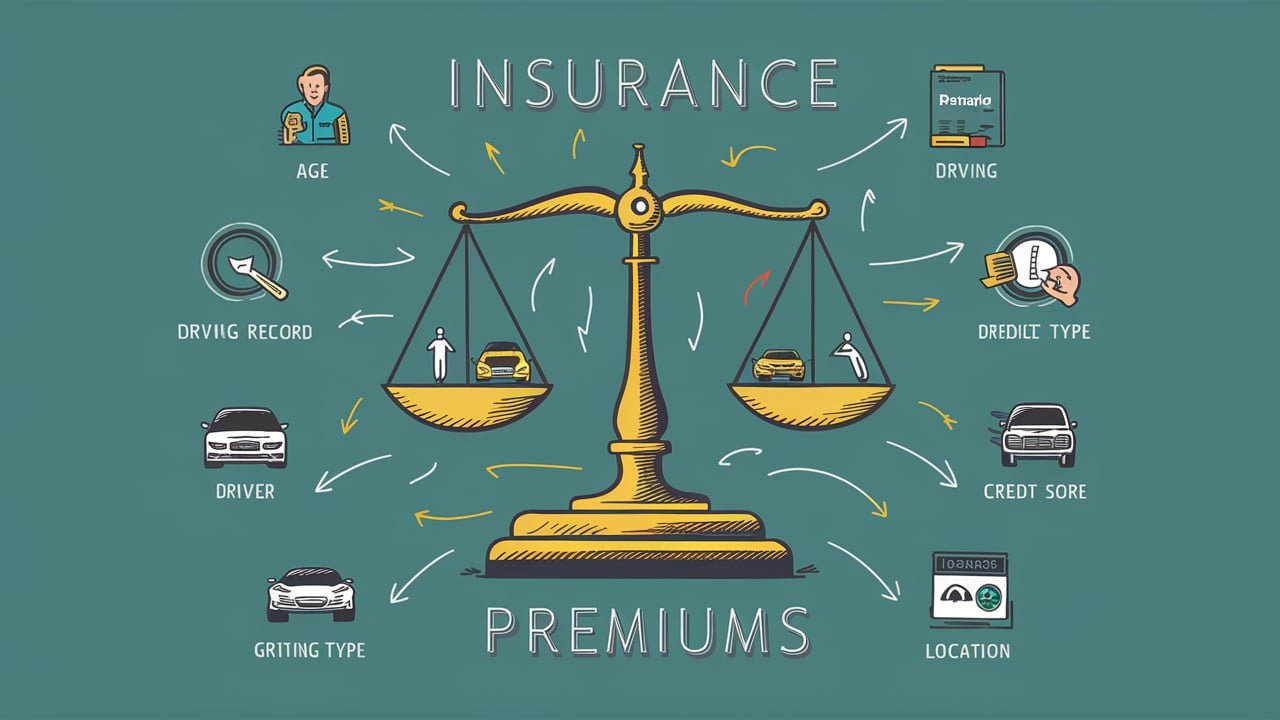

When it comes to insurance, understanding what affects your premium can help you make better decisions. Whether you’re insuring a car, home, or your health, many factors come into play. Let’s dive into these factors and see how they influence what you pay.

1. Type of Insurance

Different types of insurance have different factors. For example, car insurance and health insurance consider different things. It’s important to know what kind of insurance you need and what affects its cost.

2. Personal Information

Your age, gender, and marital status can impact your premium. Younger drivers, for example, usually pay more for car insurance because they are considered riskier drivers.

Age

- Younger People: Higher premiums due to less experience or higher risk.

- Older People: Can also face higher premiums due to age-related risks.

Gender

- Men: Often pay more for car insurance.

- Women: Sometimes pay more for health insurance.

Marital Status

- Married People: Often pay less for car insurance because they are seen as more stable.

3. Location

Where you live affects your premium. Areas with high crime rates or extreme weather conditions can lead to higher premiums.

Factors

- Crime Rates: High crime areas lead to higher premiums.

- Weather: Areas prone to floods or hurricanes will have higher home insurance costs.

4. Coverage and Deductibles

The amount of coverage you choose and your deductible will affect your premium.

Coverage

- More Coverage: Higher premiums.

- Less Coverage: Lower premiums but may not cover all costs.

Deductibles

- Higher Deductible: Lower premium but more out-of-pocket costs when you file a claim.

- Lower Deductible: Higher premium but less out-of-pocket costs.

5. Claims History

If you have a history of filing many claims, insurers may see you as a higher risk, leading to higher premiums.

Claims

- Frequent Claims: Higher premiums.

- No Claims: Potential discounts.

6. Credit Score

In some cases, your credit score can affect your premium. Insurers believe that people with higher credit scores are less likely to file claims.

Credit Score Impact

- Good Credit: Lower premiums.

- Bad Credit: Higher premiums.

7. Type of Vehicle or Property

The type of car you drive or the home you own can influence your premium. Luxury cars and high-value homes generally have higher premiums.

Vehicle

- Luxury or Sports Cars: Higher premiums.

- Older or Safer Cars: Lower premiums.

Property

- High-Value Homes: Higher premiums.

- Older Homes: Can sometimes have higher premiums due to potential maintenance issues.

8. Usage

How you use your insured item also affects your premium. For example, a car used for commuting daily will have a different premium than a car used occasionally.

Car Usage

- Daily Commuting: Higher premiums.

- Occasional Use: Lower premiums.

Home Usage

- Primary Residence: Standard premiums.

- Vacation Home: Higher premiums due to potential vacancy risks.

Learn More Latest Article: Claims Process and Settlement: A Step-by-Step Guide

Conclusion

Understanding these factors can help you make informed choices about your insurance. By knowing what affects your premium, you can find ways to lower it or choose the best coverage for your needs. Always compare quotes and ask your insurer about discounts to get the best deal.