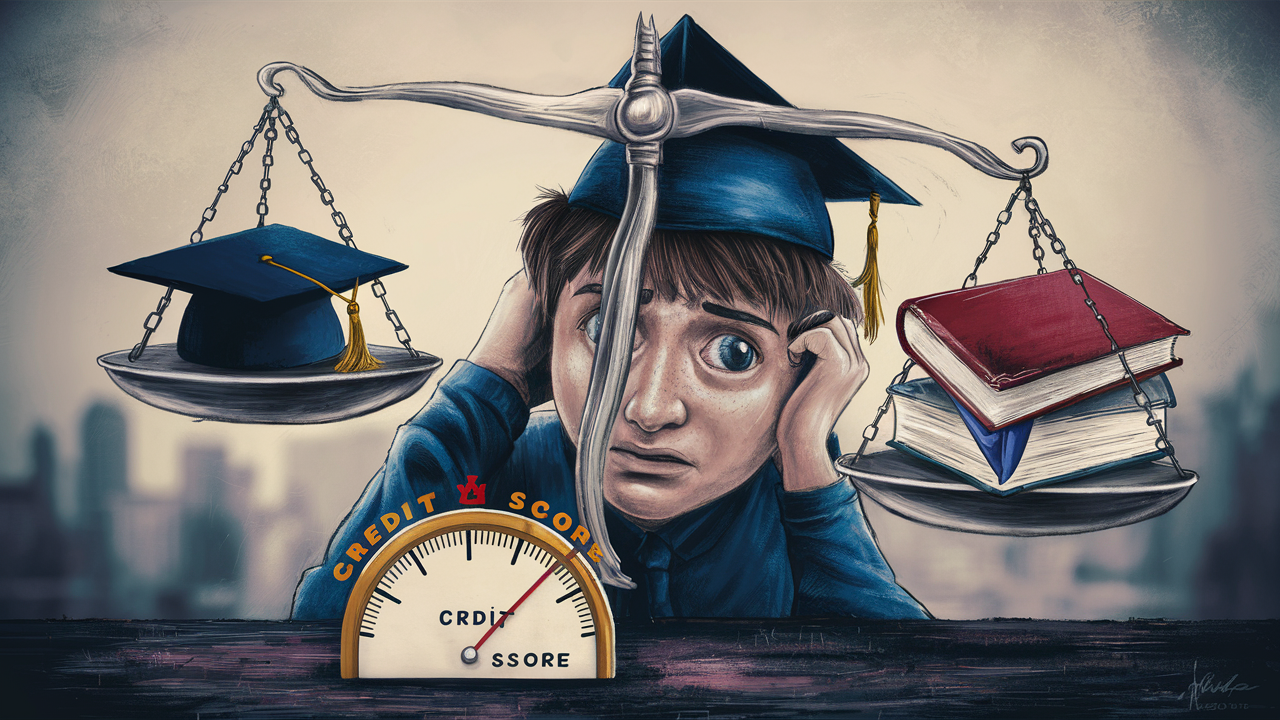

Student loans can impact your credit score in several ways. If you make your payments on time, your credit score can improve. But if you miss payments, your score can drop. Student loans also contribute to your credit mix, which is the variety of credit types you have. A good credit mix and a long credit history can help improve your credit score.

Key Points to Remember

- Credit Mix and History: Student loans add to your credit mix and help build your credit history.

- On-Time Payments: Paying on time helps your credit score.

- Missed Payments: Missing payments can lower your credit score.

- Relief Options: Deferment, forbearance, and income-driven repayment (IDR) plans can provide temporary relief but may impact your credit score.

- Refinancing and Consolidation: These options can help manage your student loans better.

Understanding Credit Scores

Your credit score is a number that shows how well you handle credit. It helps lenders decide if they should give you a loan. Here’s what goes into your credit score:

- Payment History: 35% (whether you pay on time)

- Amounts Owed: 30% (how much credit you’re using)

- Length of Credit History: 15% (how long you’ve had credit)

- New Credit: 10% (new accounts and inquiries)

- Types of Credit: 10% (different kinds of credit, like loans and credit cards)

Making your student loan payments on time is very important for your credit score.

How Student Loans Impact Credit Scores

When you get a student loan, your credit score may drop a little if a hard inquiry is needed. Most federal loans don’t require a credit check, so this won’t affect your score. However, PLUS loans and private loans do need a credit check.

After you get your loan, your payment history is the most important factor. Late or missed payments can lower your credit score, while on-time payments can improve it. Student loans can also help your credit mix if you mostly have credit cards.

Deferment and Forbearance

If you can’t make payments, you might be able to defer or put your loans into forbearance. Deferment is for situations like going back to school or military deployment, and forbearance is for financial hardship. With deferment, you don’t have to make payments, but interest might still grow. With forbearance, you can stop payments for up to 12 months, but interest will keep growing. Missing payments won’t hurt your credit unless you default, which means not paying for 270 days.

For private loans, if they offer a hardship program, make sure to join it before missing a payment to avoid hurting your credit score.

Relevant Article: How to Apply for Student Loans

FAQs

Why Did My Credit Score Drop After Paying Off My Student Loan?

Paying off a student loan can lower the average age of your credit accounts and reduce your credit mix, causing a temporary drop in your credit score.

Can a Student Loan Impact a Co-Signer’s Credit?

Yes, if the borrower doesn’t make payments, it can show up on the co-signer’s credit report and affect their debt-to-income ratio.

How Does Student Loan Forgiveness Impact My Credit Score?

If your student loans are forgiven, your credit score might drop temporarily because your credit mix and credit history length will change.

Conclusion

Student loans can affect your credit score in various ways. Making on-time payments is key to building a good credit history and avoiding negative impacts. If you have trouble making payments, consider an income-driven repayment plan to keep your payments manageable.